Purchase Property With Little To No Deposit

Get Your Keys Faster

We help people who are unable to source a deposit get off the rental cycle and onto the property ladder.

Have a look at some of our successful clients by clicking below.

Our mission is to help everyday people to achieve property ownership.

Getting onto the property ladder is achievable with our Accelerator Programs

1. Find Out If You Qualify

Simple - Easy - Affordable. Learn about your options.

2. Secure Approval

Mortgage broker support to help secure your approval sooner.

3. Learn About Our Accelerator Programs

Understand the team of professionals, process and fee's involved with the program

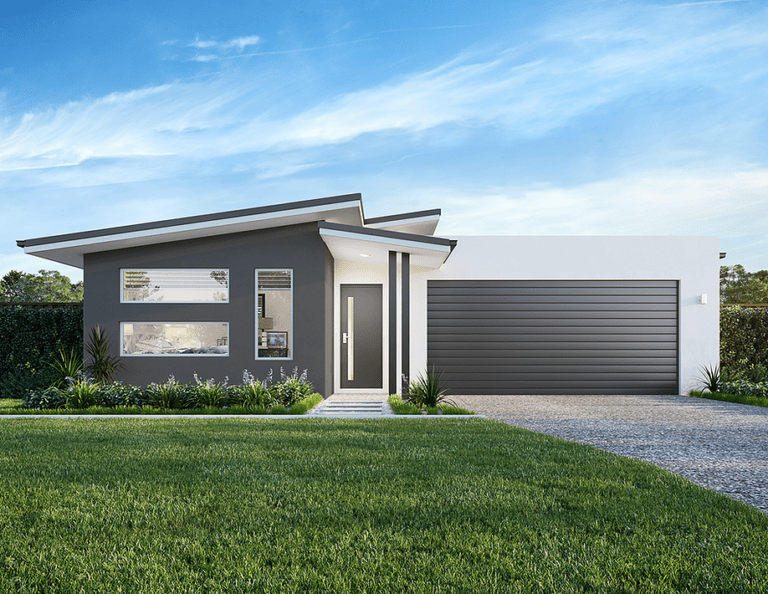

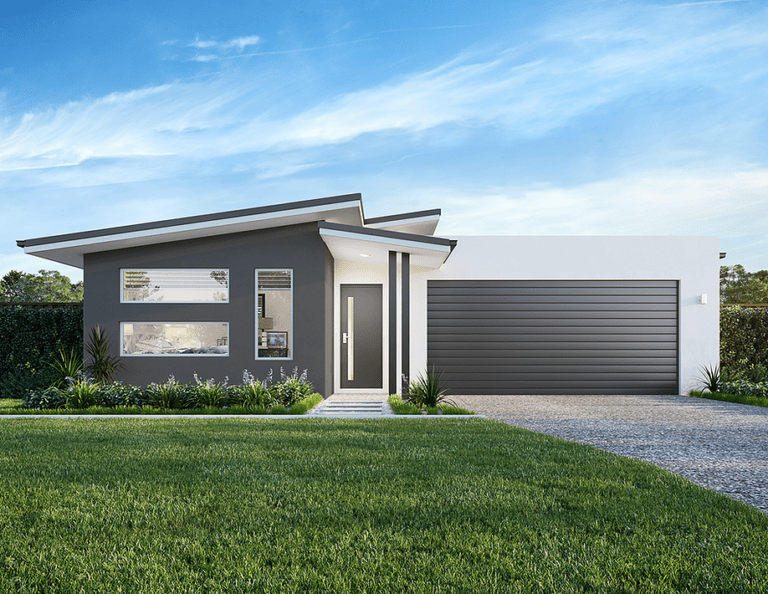

4. Select Your Property

Select between an established property or a land and build in your ideal location.

5. Settle On Your Property

Watch and enjoy as your new home is being constructed or get ready to move in.

HomeBuyer Accelerator

In today’s market, trying to save enough money for a deposit to buy a home can feel like an uphill battle. Whether your financial position has changed due to unforeseen circumstances or the everyday costs of living and rent have prevented you from saving enough, home ownership and achieving the great dream of home ownership feels increasingly impossible for many.

However, there is an alternative to relying on savings alone that most people are unaware of. With our HomeBuyer Accelerator program, you can get onto the property ladder with our no money down solution.

Find out how you can purchase a home.

Property Portfolio Accelerator

If you fail to plan, you plan to fail. If you want to set yourself up for financial freedom, you need a plan. But sadly most people leave it too late or don’t take action at all.

Property investment is one of the most effective ways to achieve financial independence in retirement by creating passive income – which is one of the best-kept secrets. With our Property Portfolio Accelerator solution you can build wealth, earn a passive income, and enjoy a comfortable retirement.

Find out how to use your super to invest in property.

Happy Client Success Story

How We Helped John and Tammy Buy Their First Home.

Meet John and Tammy, a couple from Brisbane, QLD who transformed their dream of homeownership into a reality through our unique deposit program. While many grapple with the challenge of mustering a substantial upfront deposit for their homes, John and Tammy took a different route. They chose our program specifically because it allowed them to preserve their hard-earned savings for other endeavors and aspirations, rather than sinking a significant amount into a hefty home deposit.

But that’s not all. By collaborating with us, they not only were able to craft their brand-new home in Brisbane but also avoided the often burdensome lenders mortgage insurance. Thanks to our program’s capabilities, we assisted them in achieving a 20% deposit. Today, John and Tammy stand as a testament to what’s possible when you harness smart solutions to achieve big dreams.

Are you ready to see if you qualify?

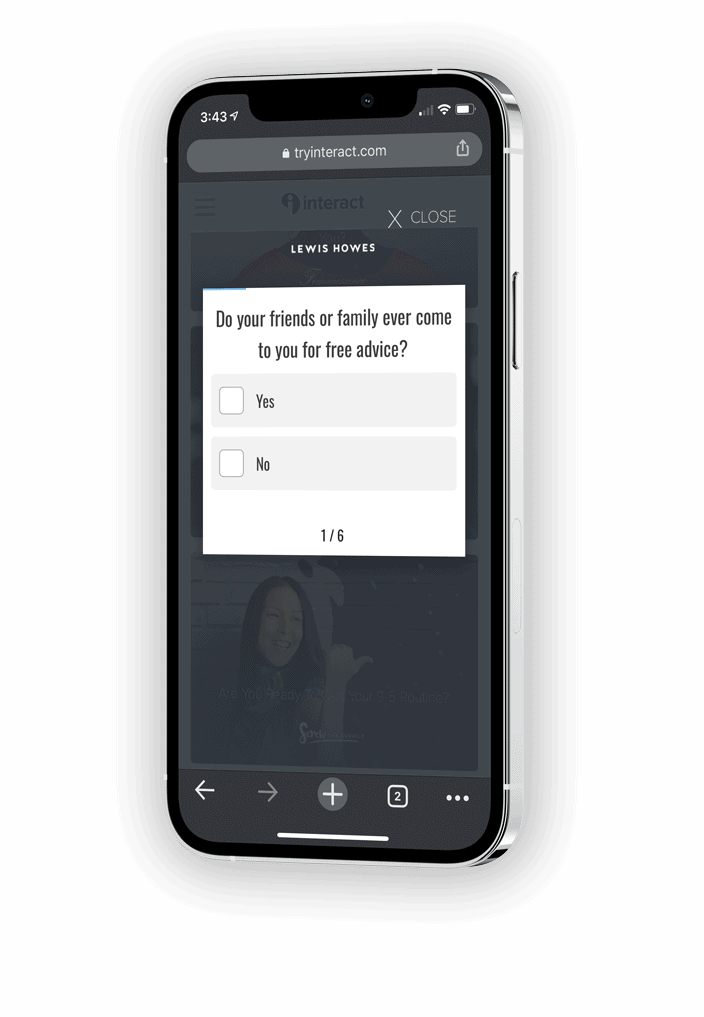

TAKE OUR QUIZ TO SEE IF YOU QUALIFY FOR OUR PROGRAMS

Property and Investing

From Our Learning Centre

Low or No Deposit Home Loans

For many Australians, getting onto the property ladder can feel like an unachievable goal. Getting a deposit together is hard, especially when life regularly throws

3 Expert Tips to Help You Buy Property at the Right Time in Australia

Are you considering buying a property, but feel confused about when you should act? In this article we share 3 expert tips on getting the timing right.

Building vs. Buying Your New Home: 5 Key Considerations That Will Help You Decide

Both building and buying can be a great choice, but the key to finding the right fit is to measure it against your circumstances. Here are 5 key considerations.

7 Financial Dos and Don’ts that Will Help You Improve Your Credit Score

If your credit score is not where you’d like it to be, there is much you can do to turn it around. In this article we share our 7 financial dos and don’ts.

Case study: How we helped James and Narelle buy their first home without a deposit

In this case study, learn how we helped James and Narelle purchase a beautiful home on the Gold Coast to live in with their family, without a deposit!

You Can’t Use Your Super to Buy a Home … But You Can Leverage It

Leveraging your super to create a house deposit can be a really effective strategy to get you off the rental trap and into your own home sooner. Here’s why.

Low or No Deposit Home Loans

For many Australians, getting onto the property ladder can feel like an unachievable goal. Getting a deposit together is hard, especially when life regularly throws

3 Expert Tips to Help You Buy Property at the Right Time in Australia

Are you considering buying a property, but feel confused about when you should act? In this article we share 3 expert tips on getting the timing right.